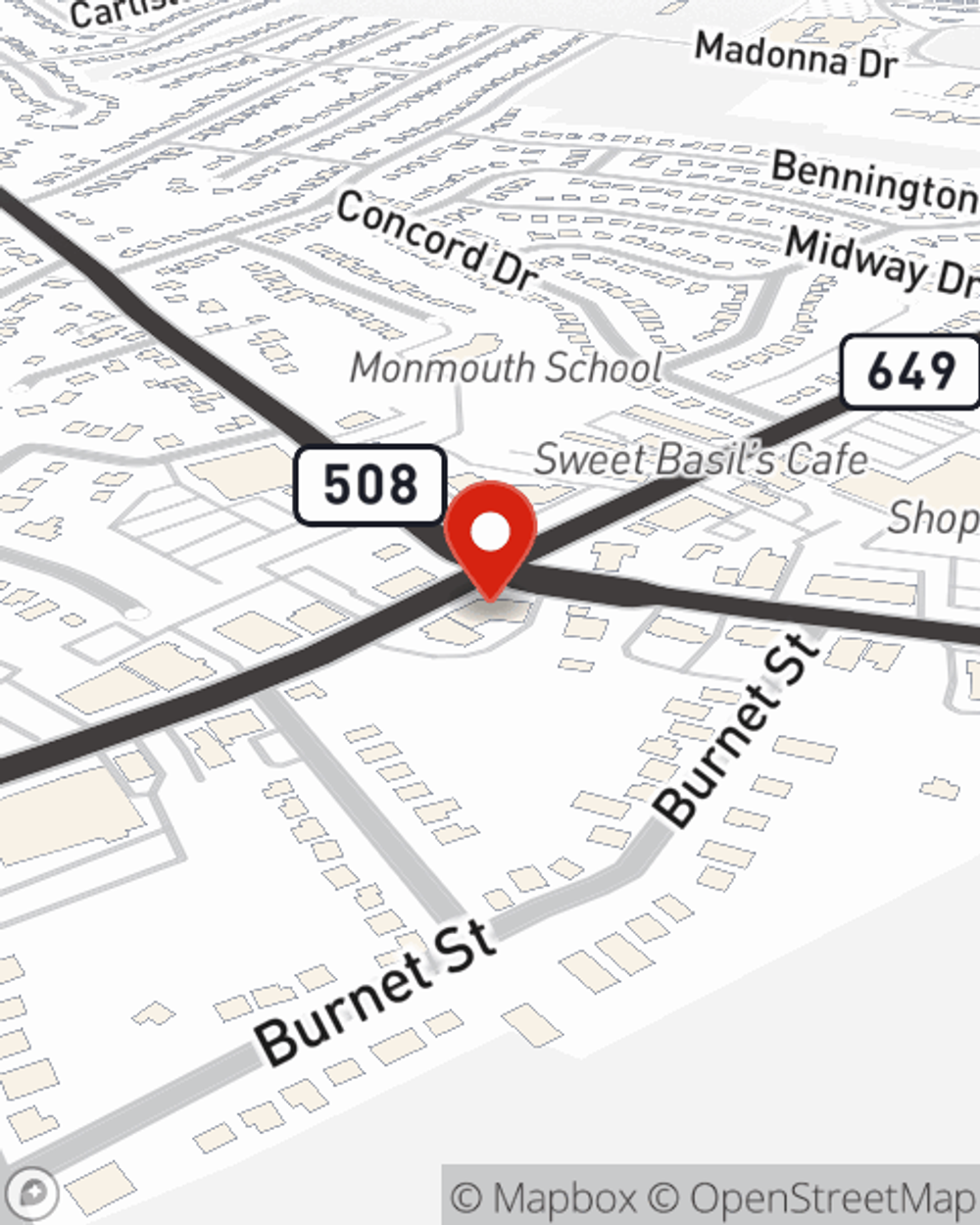

Business Insurance in and around Livingston

Calling all small business owners of Livingston!

No funny business here

- Livingston

- New Jersey

- New York

- PA

- Essex county

This Coverage Is Worth It.

It takes courage to start your own business, and it also takes courage to admit when you might need help. State Farm is here to help with your business insurance needs. With options like worker's compensation for your employees, a surety or fidelity bond and extra liability coverage, you can rest assured that your small business is properly protected.

Calling all small business owners of Livingston!

No funny business here

Protect Your Business With State Farm

When you've put so much personal interest in a small business like yours, whether it's a home cleaning service, a pizza parlor, or a dry cleaner, having the right coverage for you is important. As a business owner, as well, State Farm agent Sandra Suarez understands and is happy to help with customizing your policy options to fit what you need.

Get right down to business by getting in touch with agent Sandra Suarez's team to review your options.

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Sandra Suarez

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.